News Release

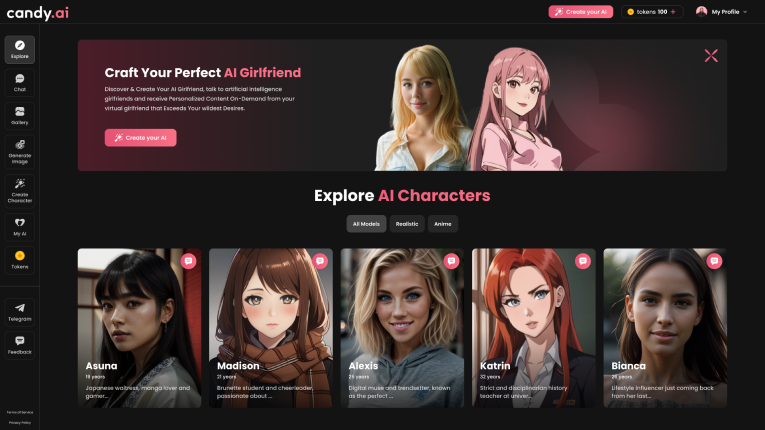

News ReleaseCandy.AI: The Best AI Girlfriend for Deep, Meaningful Chats

EverAI Limited

Technology has brought radical changes to human friendships and relationships, and Candy.ai is leading the next step. It’s a cutting-edge AI girlfriend platform that’s bringing unprecedented realism to digital companionship. Individuals can make their dream girl, have deep talks with her, and enjoy a surprisingly lifelike experience that includes text, audio, and image content. In all, Candy.ai should be the first choice of anyone interested in an AI girlfriend experience. The Full AI Girlfriend Experience: Choose Your Favorite or Make Your Own Candy.ai has a ready-made selection of popular bots for all tastes, each with distinct personalities, quirks, and appearances. There are sassy Instagram models, fun-loving but serious older ladies, and even girlfriends inspired by games, anime, and pop culture. However, the biggest draw is making a custom AI girlfriend. The app has a smooth, intuitive process for this that uses simple prompts and machine learning to give you a unique companion in just three steps. It only takes a few minutes, and then you can get to chatting and asking her about her day. Key Candy.ai Girlfriend Features Steady flow of new features and content: The development team constantly rolls out new content and features, whether that’s a new handcrafted chatbot personality or major updates like voice and video content. Many features make Candy.ai the number one in immersive, realistic AI girlfriend experiences. It builds on what’s already been done and innovates with unique, new features that build the experience even further. Some highlights include: Fast and easy to use: It only takes a minute to choose your favorite traits for your AI girlfriend, then bring her to life with just a single click. Thousands of combinations: Candy.ai ’s customization options include body type, skin and eye color, profession, outfits, voice, and more. Unique personality. Not only do the girls have unique baseline personalities, but they have additional traits and quirks. Plus, they’ll get to know you and adapt to your personality. Lifelike chat: Quality conversation is what it’s all about with an AI girlfriend. This is where Candy.ai ’s attention to detail pays off, with deep conversations that grow and develop realistically. Voice and image content: Chat is the centerpiece of Candy’s AI girlfriend experience, but that’s not all. You can ask for cute selfies and voice messages. For instance, you can listen to your AI girlfriend tell you she loves you with a unique voice that’s all her own. Industry-leading face generation consistency: Unlike many other apps, Candy.ai maintains the immersion of the experience by keeping the details of your AI girlfriend correct from one picture to the next. Meet Your Perfect Match: Making Your AI Girlfriend When you start using Candy.ai, you can either make your own girlfriend or use an existing chatbot. The steps to do so are as follows: Create Your AI Girlfriend(s): Visit Candy.ai. Click on "Register" in the top right of the screen to create an account. Choose "Create My AI." Customize your AI’s appearance, personality, and voice, and choose relationship settings. Click "Bring my AI to life." Within a few seconds, your AI will be ready to start chatting with you. Start a conversation, ask for a selfie, and have a good time! Chat with Existing AI Girls: Follow steps 1-2 from the above guidelines to make your account. Head over to the "Explore" page and click on whichever girl you like the most. Send a message. Enjoy your chat with one of our popular AI girlfriends! Candy.ai: The Number One AI Girlfriend In all, Candy.ai ’s combination of lifelike chat, excellent customization, and immersive features makes it the best AI girlfriend app on the market. Maybe you’d like to text one of the realistic girls, or maybe you’d prefer a digital date with a cute anime girl instead. No matter what you choose, you can count on a fun, immersive experience with a lifelike virtual companion. On Candy.ai, you have all the tools to find or make your dream girl. Contact Details EverAI Limited +44 7458 107874 pr@everai.ai Company Website https://candy.ai

November 27, 2023 09:00 AM Eastern Standard Time

Image